Review:

Yesterday the gold opened at 664.3, day high 667.5, day low at 661.8 and closed at 663.5. The tension in Iran have tightening the market, investors are holding and wait for the result from British and Iranian. Market is now focus on the resolution of Iran and US market data. Oil dropped 1.91% as Iran foreign office stated they will not get the hostage for trial. It seems soften the tension in Iran. Market expect Iran would not dispute the oil supply. Iran is the second biggest oil supplier.

Technical:

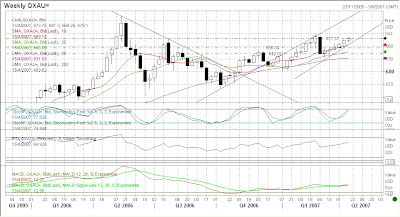

Weekly Chart

On the weekly chart indicate the gold is on a up trend. While all analysis indicators indicates the up is still running in bullish trend. The gold has reached 656 on Monday and hasn't break through last week top at 669. It maybe a signal for gold is switching from bullish to netural. It may also go further to bearish.

Daily Chart

Daily chart indicate more clearly that the gold is now resist on 668. At the moment, it hasn't have much clear direction. However, the gold has already test the resistance for couple of times. RSI is slightly on top of 50. MACD and stochastic also inidicate the gold is on bullish. SMA 20 is below SMA 50 while SMA 10 is above SMA20. The would be a hint for gold is now on a turning point.

Market Data and News:

MBA mrotgage Applications (30 March), consensus with 12.5%, prior -0.2%.

Challenger Job Cuts (YoY) (March), prior -3.9%

ADP Employement Change (Mar), consensus 128K, prior 57K

Factory Orders (FEB), consensus 2.2%, piror -5.6%.

ISM non-Manufacturing (Mar), consensus 55, prior 54.3

EIA crude oil inventory (March 30), prior -0.9M

Strategy:

Long Position: 664, 656

Stop Loss: 661, 653

Short Position: 667, 660

Stop Loss: 669.5, 663